The annual Electric Vehicle Outlook (EVO) report from “BloombergNEF” forecasts nearly 22 million sales of 100% electric and plug-in hybrid vehicles this year, which, if confirmed, represents a 25% increase compared to 2024. According to the same source, this is driven by the decline in the cost of lithium-ion batteries and the increase in the production of more affordable electric models.

The document notes that China accounts for nearly two-thirds of these sales, followed by Europe with 17% and the USA with 7%. Furthermore, plug-in hybrid vehicles are expected to represent one in every four vehicles sold globally this year, “a remarkable growth compared to just a few years ago, when less than 5% of global vehicle sales were electric”, adds the report.

In the USA, the outlook is bleak. Although the forecast is for electric vehicle sales to increase from 1.6 million in 2025 to 4.1 million in 2030, this number represents 14 million less than previously estimated. A particularly critical issue is the legal dispute over California’s special exemption regarding emission levels. If the state with the highest number of vehicles in circulation in the USA loses its special authority, sales figures may drop even further.

In this way, China continues to maintain its leadership over Europe and the US, being the only country where electric vehicles are, on average, cheaper than internal combustion vehicles. Further demonstrating China’s dominance, the report states that “69% of electric vehicles sold globally in 2024 were manufactured in China, with Chinese manufacturers having a significant presence in electric vehicle sales in emerging markets such as Thailand and Brazil. These sales, combined with an evolving political landscape in the US, have raised adoption in some emerging markets, such as Thailand, to a level higher than that of the US”. Outside of China, the UK leads among major markets and ranks first in electric vehicle adoption among the large countries in Europe, ahead of Germany.

“2024 was a landmark year for electrified transport, with electric vehicles reaching global sales records and rapidly increasing adoption in emerging markets in Asia and Latin America. Despite these tailwinds, we anticipate slower adoption of electric vehicles in the short and long term, largely due to changes in the landscape in the US. This shift in global adoption will also have significant impacts on the battery industry, leading to an oversupply in production.”, said Colin McKerracher from BloombergNEF and the lead author of the report.

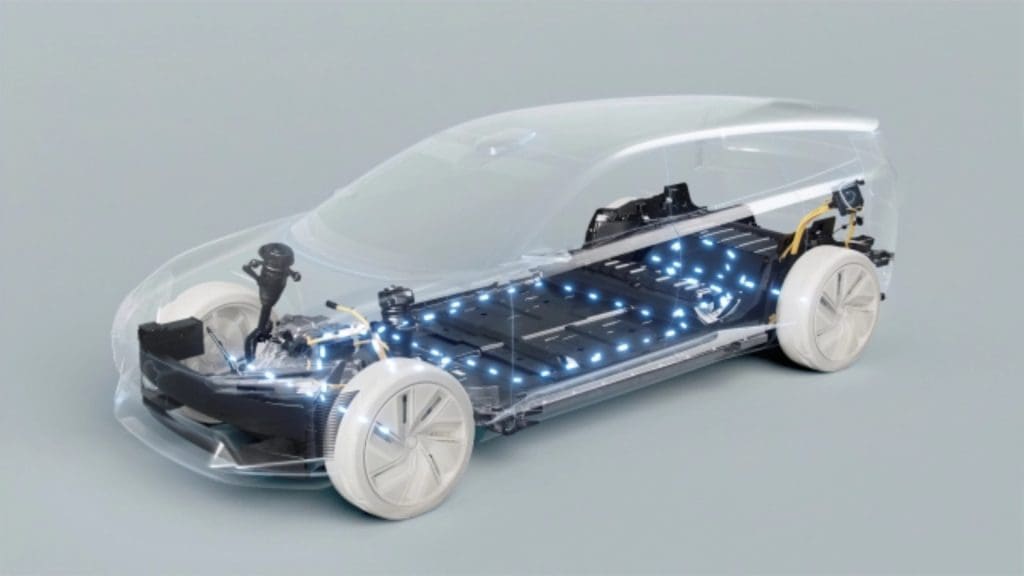

The report notes that, although the demand for batteries for 100% electric vehicles is still growing, it is lower than in previous projections, having decreased by 8% in the projection between 2025 and 2035, compared to last year’s, “which corresponds to a reduction of 3.4 terawatt-hours in battery usage – most of which (2.8 TWh) can be attributed to the decline in sales of passenger electric vehicles in the U.S. This dynamic is causing a continued excess capacity, reducing battery costs and intensifying competition in the market”.

Furthermore, the report also states that charging prices are becoming increasingly critical. Although many users benefit from home charging, which is up to 60% cheaper than gasoline, the prices for public fast charging of electric vehicles have increased significantly in the U.S. and Europe since 2022. In some cases, the cost per kilometer is even higher than that of combustion engines. This situation is seen by “BloombergNEF” as a potential factor to deter new buyers from electric vehicles.